How Li Ka-shing became Hong Kong’s richest billionaire

When it comes to its richest people, Asia loves to give a nickname.

There’s the King of Coal (Indonesia’s wealthiest businessman Dr Low Tuck Kwong, PT Bayan Resources), the Sugar King (Robert Kuok, the 99-year-old Malaysian founder of The Kuok Group), and the Paints Tycoon – Singaporean Goh Cheng Liang, who has amassed most of his wealth from taking a majority stake in Japan’s Nippon Paint Holdings.

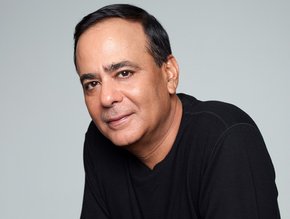

None however have quite the cachet of Superman – aka Li-Ka-shing – the Hong Kong billionaire business magnate, investor, and philanthropist behind multinational conglomerate CK Hutchison Holdings, amd Hong Kong’s largest family business.

In a career spanning more than half a century, Li has amassed one of Asia’s largest fortunes by manufacturing plastic, building skyscrapers, selling soap, and heating homes.

As Hong Kong’s richest person, and the fourth richest in Asia – with a net worth of US$39 billion, according to Forbes – Li is widely considered one of Asia’s most influential businessmen; given the Superman moniker for his astute dealmaking and investment acumen.

Though now retired as Chairman of CK Hutchison Holdings, having hung up his corporate shoes in 2018, the 95-year-old billionaire has dedicated decades to building CK Hutchison into a diversified multinational with more than 300,000 employees operating in more than 50 nations and annual revenues of US$57.3 billion.

Now led by his elder son, Victor Li Tzar-kuoi, Li himself remains a senior advisor for CK Hutchison and sister company CK Asset Holdings.

Li’s story is truly one of rags to riches.

From poverty to plastics

Having arrived in Hong Kong in 1940 as a 12-year-old refugee from war-torn China, Li was forced to find factory work aged 14 after his father died – working 16 hours a day in a plastics company. He eventually became the factory’s top salesman and was promoted to factory manager aged 18.

Ambitious and entrepreneurial, the young Li soon ventured out on his own, and in 1950, at the age of 22, started his own plastic manufacturing business, Cheung Kong Industries, opening his first factory with US$6,500 in savings and loans from family members. Among the company’s many clients, Hasbro commissioned the factory to make G.I. Joe dolls for export to the US.

Not limiting himself to plastics, Li led and developed his company into a leading real estate investment company in Hong Kong, which he listed on the HK stock exchange in 1972.

Known to make smart local property investments, often buying when others sold – including acquiring Hong Kong property during the cultural revolution in 1967 – Li has been likened to Warren Buffet.

Having cemented his wealth with some judicious local property investments, Li began to diversify and make smart, strategic investments into growing sectors including ports, energy, retail, telecoms and biotech.

Building a Hong Kong empire

Li made key acquisitions, first in Hutchison Whampoa in 1979, becoming the first person of Chinese origin to own one of the British-founded companies that dominated Hong Kong’s economy since its founding in 1941, and in 1979 acquired Hongkong Electric Holdings – before entering the mobile telecoms market in 1983.

Among Li’s many other smart deals, the sale of his Orange mobile-phone unit in the UK to Germany’s Mannesmann AG in 1999, the A$7.4 billion takeover of Australian power provider Duet Group in 2017, along with major investments in tech startups including Facebook, Spotify and Siri.

In 2015, the billionaire businessman restructured his major holdings into two companies – one operating his property assets (CK Asset Holdings) and the other (CK Hutchison Holding) holding the rest, including CK Infrastructure Holdings and Power Assets Holdings.

Today, the group operates a diverse range of businesses, spanning telecoms, port services, retail, energy and infrastructure – and has become a world leader in port services, holding interests in 54 ports in 25 countries, and a leader in the telecoms industry, now serving 176 million customers worldwide.

Among its world-class retail offer, Watson Group is the world’s leading global health and beauty retailer with 16,300 stores in 28 markets, operating not only Watsons, but also ParknShop supermarket and in Europe – brands including Superdrug and Savers.

In fact, Li-controlled companies are among the biggest foreign investors in the UK – including the UK’s biggest pubs and brewery group, Greene King, which CK Asset Holdings snapped up for US$5.6 billion in 2019.

Giving back to society

As well as his prowess on the business front, Li is renowned in Hong Kong and across Asia for his generosity.

Passionate about education, in particular, Li established the Li Ka-shing Foundation in 1980, with the aim to nurture a culture of giving, supporting education reform and advancing medical research.

The following year, he founded China’s only privately-funded public university, Shantou University, and via both, he has since donated a large portion of his wealth to charity – more than US$3.8 billion, with over 80% focused on Greater China.

Upon retiring in 2018, Li said it had been his “greatest honour” to have founded Cheung Kong and to “have served society”.

- Top 10 best-performing family businesses in Hong KongCorporate Finance

- Asia is home to 18 of the world’s 50 best hotelsSustainability

- Top 10 chaebol chiefs: driving conglomerates in South KoreaLeadership & Strategy

- Singapore vs. Hong Kong: the battle for the family officeCorporate Finance