Researching the potential of quantum computing in finance

The financial mechanisms underpinning global trade are undergoing significant change.

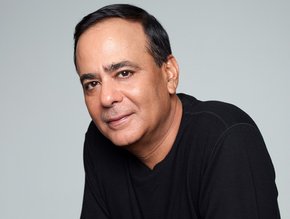

Although disparate systems remain the norm, Tradeteq's Michael Boguslavsky explains how quantum computing has the potential to transform this trillion-dollar industry over the next decade.

It is noteworthy that trade finance – a USD$15trn a year industry that has been in existence for centuries – is largely paper-based but is undergoing a significant wave of digitisation. As we look ahead to the next decade, technological advances offered by fintechs are being adopted and will re-shape the industry as we know it.

While artificial intelligence, blockchain and other forms of fintech have a key role to play, one technology that could be a potential gamechanger is quantum computing. Although it remains at an early stage of development and not yet suited for anything other than very small pilot problems, the smartest fintechs are looking ahead to how it can be applied not tomorrow or next year, but a decade from now.

Quantum computers enable the processing of multiple combinations of input data at the same time. Using the unobserved quantum state of very small quantum systems, rather than the classical use of transistors as the basis of computing, could lead to far quicker processing times over standard classical machines.

In trade finance, we have seen experiments with simulated quantum algorithms for portfolio optimisations, and the early results have been quite promising. At Tradeteq, we are exploring the extent to which simulated quantum or actual quantum computing can help with classification and prediction problems, including credit scoring.

The advantages of quantum transaction scoring

Broadly speaking, there are two forms of credit scoring that are commonly used: company credit scoring and transaction credit scoring.

Company credit scoring is a relatively long-standing area of credit analysis and can be conducted in many ways. However, the amount of data available is often limited, particularly in the case of smaller companies in developing economies. This limits the complexity of feasible models and there is little value in over-engineering a solution.

Where the real potential lies is in the transaction scoring. For a trade finance transaction, there is potentially an unlimited amount of data to process, from real-time ship tracking to data on similar transactions. You can look at transactions involving the same buyer or seller, their peer group, transactions of similar goods or between similar countries. This unlocking of previously unavailable vast data flows will challenge many existing models.

Our company models handle a few hundred features per company. Most of these features change very slowly, typically only once a year. The current generation of transaction models handle daily updates to tens of thousands of variables, most of which are not relevant for any given transaction risks.

We need to prepare the next generation of models that would work smartly with a greater number of variables that can be updated at higher frequency. This is where future quantum computing systems might help.

So, we have embarked on a research project with Singapore Management University (SMU), which has significant experience in quantum devices and the application of disruptive financial technologies. Initially, we will be looking at replicating simple toy-company level models on quantum systems to learn how they can be used for more complex models – when capacity of those systems improves enough to challenge the current state-of-the-art classical implementations.

Future-gazing the next wave of innovation

Getting to a point where quantum computing can match the functionality of classical systems will take years, so this is not something I expect to be in our production system this year or even when our research concludes in two years. Based on the quantum systems currently available, there is no practical way to factor in more than 15 or 20 features, let alone 300.

But whether it is rolling out a new form of UI for their customers or overhauling a back-end legacy issue, fintech innovation in trade finance is gathering pace. As we have seen in other industries, it is vital to look ahead, have long-term goals in mind and invest in technology and innovation, or risk becoming obsolete.

In an industry like trade finance that has seen little change over centuries, there is clear potential for transaction scoring to be reformulated in such a way that they will be able to be solved by quantum computing.

The successful application of this technology could be a true gamechanger. Not only will it enhance the technological and operational capabilities of institutions, but it could the key to achieving greater transparency, participation from SMEs in all global regions and a reduction in the $1.5trn trade finance gap.

This article was contributed by Michael Boguslavsky, Head of AI at Tradeteq